Market Summary A Turbulent March 2024 Month Ends on a Positive Note

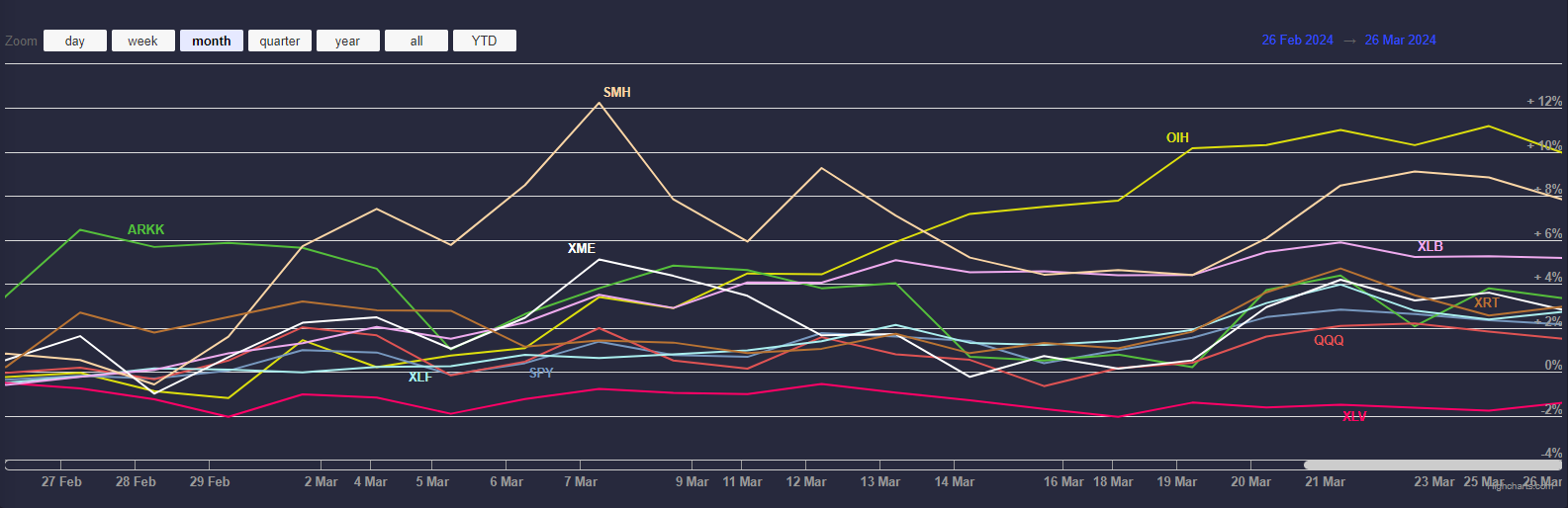

March 2024 witnessed a volatile period in the stock market, with sector performances painting a diverse picture as depicted in the latest monthly chart. Despite some sectors showing signs of struggle, the overall market sentiment has tipped towards cautious optimism.

Leading the Pack

The Semiconductor sector, represented by the ETF SMH, experienced a steep climb, followed by a sharp drop, only to recover remarkably towards the month's end. This rollercoaster ride ended with it leading sectoral gains by an impressive margin.

The Oil and Energy sector, tracked by OIH, also saw significant gains, showcasing resilience amidst fluctuating oil prices and global market pressures. It maintained a steady uptrend, securing a robust position with over a 10% increase.

Innovation and Technology: A Mixed Bag

ARK Innovation ETF (ARKK), known for its focus on disruptive technology, experienced a tumultuous month, peaking sharply mid-month but closed off slightly above its starting point. This shows the volatile nature of investing in cutting-edge technology companies.

The NASDAQ-100, tracked by QQQ, tells a story of recovery. After an initial dip, it made a commendable comeback to finish just above the baseline, signaling investor confidence in tech giants.

Materials and Finance: A Steady Climb

The Materials sector (XLB) and the Financial sector (XLF) showed a parallel trajectory of steady growth throughout the month, indicative of underlying strength in these foundational sectors.

Lagging Behind

On the other end of the spectrum, the Consumer Staples sector (XLP) and the Real Estate sector (XLRE) didn't fare as well, with XLP showing a consistent decline over the month, hinting at possible consumer spending shifts.

Conclusion

In summary, while some sectors faced headwinds, others soared, reflecting the dynamic and ever-changing nature of the stock market. Investors seem to be favoring sectors tied to growth and recovery as we observe selective sector outperformance. This month's chart emphasizes the importance of diversification, as sector performances have varied greatly. The market continues to keep the investors on their toes, and as always, a well-researched, balanced portfolio could be the key to navigating these uncertain times.